Achieving dependable telecom tax compliance can be a complicated road and without a proper roadmap, or checklist, can end up jeopardizing your business with crippling penalties and interest. We teamed up with Rev.io to put together a checklist of items to help you achieve telecom tax compliance and recorded this live webinar to walk through it, as well as answer questions live in real-time.

Watch the webinar now – transcript is included below!

Delaney Dabkowski:

Hi, everyone. And welcome to today’s session. On behalf of everyone at Rev.io, I’d like to thank you for joining us today. I’m Delaney Dabkowski, Rev.io’s field marketing manager. Before we begin the presentation, I’d like to go over a few housekeeping items. First, audio will automatically come in through your computer speakers. Second, a recorded version of this webinar will be emailed to you within two days. Third, we’ll be having a Q and A session at the end of the event so please submit your questions via the Zoom control panel at any point during the live presentation.

Delaney Dabkowski:

For those of you just joining us, welcome. Today, Dan Driscoll CRO at FAStek and Karen E. Wilkins Director of Compliance will be discussing how to build a detailed checklist to achieve dependable telecom tax compliance. Dan is the Chief Revenue Officer for FAStek Compliance Solutions. Before joining FAStek in April, 2021, Dan spent two decades in the telecommunications industry building and leading successful sales and marketing teams. He was responsible for creating customer driven successes at MCI, KMC Telecom, Hickory Tech and several more.

Delaney Dabkowski:

Karen has spent the last three years automating manual processes using Alteryx and BlackLine. She also has 12 years of experience implementing new indirect tax clients and managing the indirect tax and regulatory tax compliance process for the Thomas Reuters and KPMG. Karen received her bachelor’s degree from the American Intercontinental University with magna cum laude honor. She also received her BlackLine Account Reconciliation Certificate and the Six Sigma Green Belt. Without further ado, I’ll turn it over to Dan and Karen.

Dan Driscoll:

Thank you, Delaney for the introductions. Hello, everybody. And thanks for joining us today. Karen and I welcome the opportunity to provide you some best practices to kind of help you get tax compliance. I wanted to let you know a little bit how I came about developing the agenda for today. As Delaney said, I’m new to FAStek but in the short time here, I’ve had the opportunity to speak to many customers and prospects. And in these discussions, I received many questions associated with telecommunications taxation.

Dan Driscoll:

So our objective today is to try to answer some of those questions for you. As Delaney mentioned, Karen has many years of telecom experience so she’ll be delivering the major substance of this presentation going through the six steps of compliance. So let’s get started here. So first, I have a little part in this. And it’s really the talk about the basics of telecommunications taxation. One of the questions I receive often is, can you give me an overview of the perspective of what telecommunications tax and regulatory obligations are?

Dan Driscoll:

I will try to answer that in a question over a few slides here. First, you should know that telecommunication is a highly regulated and taxed industry as most of you probably are already aware of. And actually telecommunications is one of the most heavy tax services in the United States today. But you must also be aware that the tax laws as you know, are always kind of behind the technology because the technology is changing so fast. So, that means tax laws are basically changing constantly also.

Dan Driscoll:

The extent to which telecommunications, its taxes is really great by this slide. There are 100s of taxes and 10s of thousands of tax jurisdictions that you have to keep up with. Thus to many of you, it probably seems like it’s an overwhelming task to do internally as well as externally. It’s something for us to keep up with constantly also because there’s so many jurisdictions out there today. So if you learn anything from this webinar today, I would say that is not to take telecommunications tax compliance lightly.

Dan Driscoll:

The results can really be a lot of penalties, interests, tax expenses that really can reduce your profitability and your goals. So it’s an important part to have a plan. And one of the things we want to try to accomplish today is to provide you some of the best practices and steps to have a plan to tackle this overall objective in your company. For the types of taxes, there are many. A few of the taxes you will encounter are basically your federal and state universal service fees, your federal excise tax, state and local sales taxes, state and local and Unit one taxes.

Dan Driscoll:

And then there are many very specific state and local taxes that you’re going to have to run into and kind of researched and discover and make sure that it’s in your tax compliance. And the other thing is, there’s a potential really for a lot of small transactions when it comes to telecom taxes. And so you really need to build an automation and a system that can handle a vast majority of taxes. Even though they’re minimal in some nature, you still have to be compliant when it comes to taxes.

Dan Driscoll:

There are basically four major government agencies that you’re going to be working with. Our favorite obviously is the Internal Revenue Service. You’ll be basically working with that organization. Also the state and local government, the Departments of Revenue and associated taxes with those departments. Yes, STC, obviously that everyone needs to be compliant with. And then there are many state public utility and public service commissions that basically manage a lot of the fees on the state level.

Dan Driscoll:

And then on aside to this, many state commissions and local agencies have their own taxes. And how they apply them, that makes a need to stay abreast of many of the different laws, both all the way down to the local level. So you can see that there’s a lot to basically overcome when it comes to taxation at all different levels. So what does this all create for you? It really kind of creates a need to have tax expertise to keep up with ever change in tax landscape. You also need automation to help you efficiently process potentially 100s of tax filings each month as well as invoicing your customers.

Dan Driscoll:

You also need resources to manage the processes and programs each month. And then finally you’ll need the ability to audit all your processes to determine if you are compliant each and every month. So what we’re going to try to do in the rest of this presentation is kind of go more in depth into these various topics and see how basically we can help you kind of look through some of that. But before we do that, I always feel it’s kind of a fun thing to do from an interactive standpoint in these presentations is to take a quick poll.

Dan Driscoll:

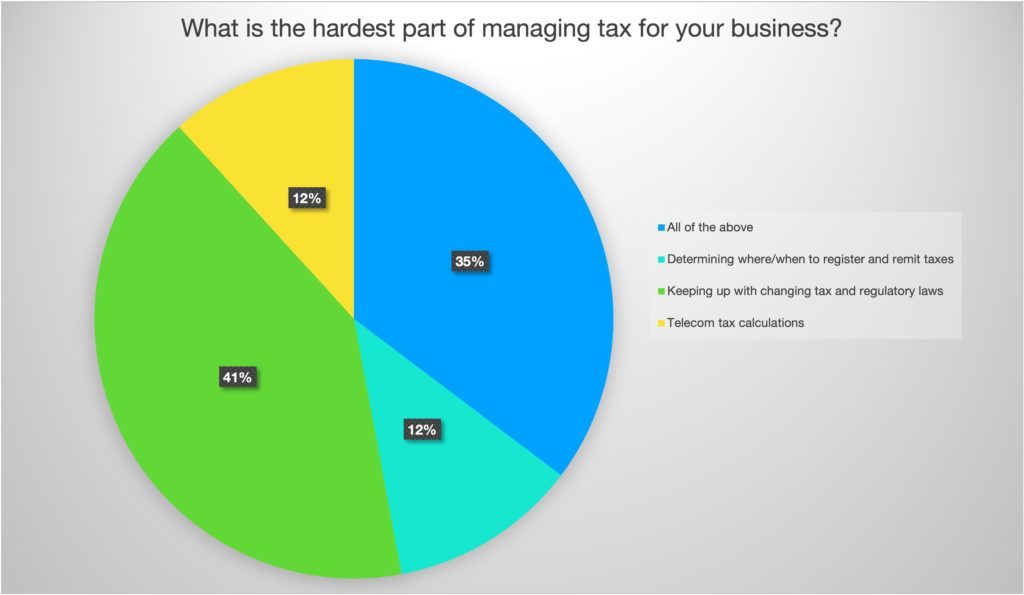

So Delaney is going to help us kind of give you an opportunity to take a poll of what is the hardest part of managing your taxes for your business today. So I see you have something on your screen here that you can kind of select one of the six options. We’ll give you a couple of seconds here to take that poll, and to see if we can get results back from it. I don’t know if we’re going to get results back. I thought we were going to but, oh, there they are, as soon as I said that.

Poll Results:

Dan Driscoll:

So really, you’re kind of just keeping up with the taxes and the laws. And obviously that is a big thing that we hear all the time that because of the magnitude and the various jurisdictions that are out there, it’s really difficult for organizations today to keep up with all the laws and regulations. And then basically your second one is kind of to determine all of the above, and so the second one. And that’s true. I mean, it’s a complex thing that you have to kind of understand all of these components, so invoicing and remitting and keeping up with tax laws.

Dan Driscoll:

So it can’t be overwhelming. So I think today, what we’re going to try to do is give you some insights into maybe how you can tackle these various areas that you just took a poll on. So I’m going to bring Karen into the conversation now. She’s going to take us a little bit more in depth with some of the final points. So tax compliance requirements. We’re going to kind of get down to what we kind of call our six checklist items that are really good best practices for you to kind of walk through and maybe think about as you kind of tackle this program within your company. So Karen I’ll kick it over to you.

Karen Wilkins:

Thanks, Dan. Appreciate it. Good afternoon, everyone. As we start a discussion about the six checklist items, you’re going to discover really that six items are really only the tip of the iceberg of what you should consider when evaluating your service offering for different compliance applications. We will start our journey with discussing the federal state and local requirements from a determination perspective. We will then proceed on to a specific certification registration with different tax authorities.

Karen Wilkins:

And of course Dan will also provide you with an overview of the calculation invoice and billing out exempts. Finally, I’ll present on the interesting world of tax compliance itself. So you can stay on this side probably, Dan. Before we start discussing really the universal service Dan, I wanted to kind of provide you, if you go back one step for me.

Dan Driscoll:

Okay. Sorry about that.

Karen Wilkins:

Now you’re good. Okay, thanks. So as you may know the universal service fund was initially created to subsidize low income households in high cost regions to make sure all customers and consumers had access to nationwide communications. Since the Telecom Act of 1996, the Federal USF was expanded to provide affordable service to healthcare providers, schools and libraries. There were four mechanisms that were created to support these initiatives.

Karen Wilkins:

Now the high policy and governance was just briefly. But high cost support mechanisms provide support to certain phone companies that serve areas where there’s most hostage to provide service, a low income support mechanism, assist low income regulatory by helping to off set once the phone charging. Now the rural healthcare support mechanism allows rural healthcare providers to pay lower rates for services comparable to those rates by city providers. Now this initiative makes to our health more affordable.

Karen Wilkins:

Now lastly, schools migrate support mechanism provides telephone service, internet access, et cetera to eligible schools and libraries. And it seems like a long list of mechanisms. However, there is more. When you report to use that, you will receive an invoice for telephone relay services, the North American numbering plan, the local member portability administration and the interstate telecom service provider regulatory fees as much to really remit from desperate just one jurisdiction, actually it’s mandate jurisdiction.

Karen Wilkins:

But really what does this mean to you? So prior, you’ll need a system in place to collect the USF and the previously mentioned surcharges from your consumers and then remit them to the appropriate agency. For the Federal USF, a wholesale, retail, intrastate, interstate and international providers in spite of the 498. And you as a provider will report projected and historical interstate, interstate and international again, whatever it is on a quarterly basis as well. Now the big one, the 498 filing due on April 1, required to break out of each service file.

Karen Wilkins:

And in my opinion, the 498 is probably the most complex return the file isn’t the provider. I know that some people on the phone would probably agree with that. Although you will not submit a payment with review of the 498, USF [inaudible 00:13:31] will also send you an invoice based on whether you’re projected in our actual revenues for you tracking yourself. It’s very important to apply the correct rates when submitting invoices. Now, I said the federal filing requirements are checked on the state here a little bit.

Karen Wilkins:

Multiple states have enacted their own funds. Each of which have some more mechanisms in place. So now there’s some relief for so many providers such as starting out. But currently, if you calculate annual contribution to the Federal USF is less than $10,000 then this will qualify you as the minimum status for the year. Although you might find this does surprise to you but it’s not relieve you of your TRS, your local number portability, the number or ITSP obligations. Nor does it mean that as a reseller, the underlying carrier will not pass along the US patents to you.

Karen Wilkins:

All right. The next slide, please. All right. So some of the things that you want to ask stuff about some state and local tax requirements. All right. So for some of these answers, you may want to acquire out within your organization or to maybe outside firms for assistance when you’re trying to answer some of these questions. But really you should ask yourself what services am I really providing and are they regulated at the Federal level? And am I regulated at the state and local levels? Again, it’s all based on the services that you’re going to be providing.

Karen Wilkins:

Now, this is a question that really determines what taxes you need to collect and remit. Then it’s like, how do you start with the next step in this adventure, right? If you determine that that services regulate need to either get some assistance from internal legal or external funds that can assist with certifications and qualifications. Well, we’ll address this component just a little bit more in detail a little bit later. For non-taxable sales are based on the product or the service you’re selling.

Karen Wilkins:

And it means that basically that product or service is not taxable in this specific jurisdiction. The most common are companies who purchase products or services who would then reassign them to the end-user. And that’s often confused now, except sales were based on end-user making a purchase. End-user has to determine that they are exempt from paying sales tax. Some types of organizations that may be exempt from sales tax are charities, government and really just organizations turning with you.

Karen Wilkins:

And again, we’ll kind of help with those a little bit more down the path. So if you go on to the next slide from me, Dan. How are the types of tax system? As Dan kind of mentioned earlier on, there’s a crazy amount of different tax rights out there. And of course he only named a few, but on this slide, you can often see their additional other ones. So now let’s talk about a little bit about them. The kind of common thing you’re going to hear about in this webinar is you, as a provider need to determine whether the service you’re providing if it’s taxable and/or reportable.

Karen Wilkins:

And as we all know, it really depends on the state. Now as an example, voiceover IP is delivered through the internet, right? It doesn’t mean that it’s not subject to tax or other tax charges. Now although regulated differently throughout the United States, but voiceover IP can be taxed at Alteryx, interstate, interstate, and local. That’s one example. The California Department of Tax and the Administrative Fees does not tax at the state level, but there’s many cities that apply utilities or tax to voiceover IP customers. Most States define telecom service different, right?

Karen Wilkins:

For example, Maryland taxable services only include mobile telephone so it was prepaid type on call. But of course, today they may change their mind or may find that something else. And that’s something that Dan referred to earlier on when he was talking about the ever changing world of regulation. Now, some types of services that may not be considered telephone but maybe taxable are installation or repair, data process, information services. Now are all revenues, intrastate, interstate taxable? Again, it really depends on the state.

Karen Wilkins:

Although some states do not have a sales tax imposed on communication services, there are still other taxable services. For example, Florida, it does not impose the sales tax on communication services, however, they do impose a communication service tax that is inclusive of the state tax. But of course, we’ll talk about some of these other things later, but there’s another example, Texas. They apply right away fee in about a thousand local jurisdictions. And over 250 cities in Missouri impose a local license tax.

Karen Wilkins:

Something to think about as far as all the different types of taxes and fees and surcharges that are possible, depending on the service that you’re providing here in Missouri or in Texas. Next slide, please. Okay. From a legal perspective, and I’m not a lawyer, I don’t want to be. I know far greater people who are definitely awesome lawyers. But I do want you to consider who is responsible for the tax, whether it’s collected from the customer or passed through the customer but not passive customer.

Karen Wilkins:

Now, your customers are responsible for paying sales tax to you are self serve to you, the provider. And you have a responsibility to report and I want say, remit tax to the appropriate jurisdiction. There are some sort of charges that may be passed through to the customer such as gross receipts tax. This tax is based on the total gross revenue, regardless its source. It’s imposed by the provider. Although it is eventually passed through to the end user. Now another example of legal incidents is not being able to pass sort of tax to your customer.

Karen Wilkins:

And in this case, you, the provider will be responsible for remitting directly to the jurisdiction and not allowed to pass that tax on the consumer. For example, Washington doesn’t have an income tax, right? But a business and occupation tax is remitted to the state based on gross income from activities conducted within the state. So yes, that would apply. Now we’re not going to get into the ever change a world that next is the termination. But some thoughts that come to mind is that, do you have a physical presence in that space like a retail outlet?

Karen Wilkins:

Can your employees or direct sales personnel live in the state? Next means that you have a presence in the State of Washington could also be determined if you have independent contracts, contractors within an agency, agents that are employers. Now, if you find you do have an access, then it is your responsibility to report. But then now you may think that you have extra system for people in the state, however as provider of telephone service, if you have customers in the state, then you must work to remit tax.

Karen Wilkins:

Sounds kind of contradictory to Dan. Now, maybe you feel that you are excluded from collecting remitting cheques because you’re reselling your services to another provider who in turn is selling the services to the end-user. Now if that provider is not collecting tax or surcharges from the customers that responsibility can fall back in your lap, and you’ll need to remit the extra charge on behalf of that reseller. Now this is where reseller figures out whether it’s the multi-jurisdiction or a specific state are extremely important, but we’ll discuss this in our slide.

Karen Wilkins:

All right. So I’m trying to figure out whether to turn my volume up. I’m hoping you guys can hear me okay. Now, as it relates to sales for resale and the exemption certificates, right? You’re required to charge sales tax on any transaction of service that is subject to tax unless the jurisdiction rules that the customer can be exempt. Or your customer qualifies for an exemption as a reseller of the services that they are purchasing from you. Now as a reseller making services, you may think that all you need is standard sales taxes or exemption.

Karen Wilkins:

However, you will probably most likely need to provide your underlying carrier, but the separate exemption for each 911 in your tax, communication services taxes, excise tax, regulatory fee, the list keeps going. Now, although the multi jurisdiction exemption form may cover you for that state, there are other states that will require you to apply for that exemption directly through those government agencies. Now, it’s important to obtain and maintain certificates based on the jurisdiction from it or they may be needed to be prior removed.

Karen Wilkins:

But as a couple of examples of state data application processes, you need to find Washington for reseller certificate. Now they extend two years. And now Florida, even communications and Sales Tax and Reseller Certificate is applied for separately but each extending one year. So you would need to have them or they would need to be renewed every year. Of course, if you’re reselling communication services and don’t want to carry your mail requests it’s actually certificates for different types of tax again the 911, sales, FET that all US tax, The TRS, the PUCs and the list goes on again on and on.

Karen Wilkins:

So Dan, can you go ahead and go to the next slide for me, please? Now on an earlier determinations slide we kind of summarized that the agency you’ll be working with and getting registered. Now if you’ve already received your Federal Tax ID Number and you’re just starting out, then you’ll need to run a complete the factory state qualification request with applicable documentation. At a minimum, you will need to provide ownership and also the information because this is a corporation. And there’s typically fees associated with some of these as well.

Karen Wilkins:

Of course, all this comes with a price, right? In addition to the secretary of state agencies, the public service commission also have to plan of your requirements. Once you receive approval from the secretary of state, we’ll kind of need to move through this slide, you can then proceed with certification with the State Public Service Commissions. And depending on your service type, it could be as simple as notifying the commission that you’ll be providing services in the state. Although in a lot of cases, you’ll need to apply for a certificate of public convenience and necessity referred to as a CPCN.

Karen Wilkins:

Now that includes filing the right tiers to the state qualifications fees, and possibly even bonds, but let’s not forget the sense that nature also that maybe acquired for those. You may have to provide office hours, your security numbers and personal identifiable information. But anyway just one thing you think that you’re done with all the paperwork, and now you have State Departments of Revenue, State USF administrators, state and local 911 boards, you got cities and villages to contact with. Now more tax registrations are needed for the State Departments of Revenue, and USF administrative outside of the Department of Revenue.

Karen Wilkins:

And those are like [inaudible 00:24:14] and GBNW. Again, they are administered by a national USF for various different states. Now for Alabama, just using an example, neither register for utility gross receipts, tax sales tax, prepaid 911. Of course, that’s all for the Department of Revenue. And yes,, for most states, they will required you to qualify with the secretary of state first. So you don’t want to skip that step. For the home rule states where the localities, the locals, the districts now they collect tax directly.

Karen Wilkins:

You might also have to register for some of those. Of course, those home rule states are your Alabama, Colorado, Louisiana. As an example, Louisiana perishes require a restriction for their sales tax rates perish. So as we move forward, I’m going to go ahead and pass the torch on to Dan, who’s going to talk about tax speculation and billing.

Dan Driscoll:

Yeah. As you can tell by Karen’s comments and in her deep analysis of all the taxes there’s certainly an awful lot out there. And so it’s back to what we kind of talked about previously is automation is really a key component to consider when it comes to taxes. One of the automation components is a tax generation platform that will help you invoice customers the appropriate taxes. And also provide accurate information to complete your tax filings.

Dan Driscoll:

So a few of the considerations to be aware of when evaluating a tax calculation or a generation platform for your company would be first, it really needs to have a robust inbound and outbound functions to communicate with your billing system. So you definitely want to make sure that the interfaces is between your billing system and the tax generation system is robust and what you need. Second, your system really needs to be updated on from a tax research database to keep you up to date as to what the taxes are on the products and services you’re offering.

Dan Driscoll:

There’s certainly needs to have robust tax calculation engine to make sure that you are receiving timely calculations on your taxes both with your customer invoices. And finally our reporting system that provides you accurate and timely information to file all your taxes. One of the important services that basically we recommend that you really need more likely outsource is the tax mapping experts have the ability to map all your services into your appropriate tax requirements to make sure that you are compliant.

Dan Driscoll:

But more importantly, to make sure that you aren’t taxing or overtaxing your customers related to your services. So it’s something that we believe that even from a maintenance standpoint, you should look at a higher taxes, are mapped to your products and services almost on an annual basis to make sure that everything’s up to date because tax and tax laws change as well as your products and services has changed. So we really kind of recommend that, that’s something that’s part of your overall program.

Dan Driscoll:

The other platform from an automation standpoint, that’s critical is really your billing system. It should have the capabilities to apply certainly with the truth in billing laws and be able to pass transactional data to your tax calculation solution, as I just kind of talked about. And so it’s really important that those two systems are working hand in hand together and the interfaces are robust and you’re doing what you need to do when it comes to the best practices of invoices. You really need to make sure that your federal taxes are presented on your customer invoices in a clear manner.

Dan Driscoll:

And also make sure that you’re separating federal and state taxes on your customer’s invoices. And then finally just kind of, you really just need to make everything as clear as possible on the invoice and abide by the truth laws that are out there. So those are some of the things from a best practices and an invoice and you really need to make sure that is in your billing system and your invoicing, the correct way based on the laws out there. So back to you Karen.

Karen Wilkins:

Well, thanks, Dan. So now it’s basically it’s time to report, right? Remit your tax to your jurisdiction. Now, if you’ll be performing a compliance process internally, then sometime it is needed even before you start completing the forms. Of course, I’m just going to check that is just again like the tip of the iceberg. There’s so many nuances to making sure that you set to report correctly. But one of the most and key ingredients is basically is identify the internal sources of your revenue and your tax data.

Karen Wilkins:

Now, ideally you’ve already been communicating internally and getting the area details. Ultimately, you will report tax to multiple authority levels, federal state, local district, city district, county district, you’ll need your tax data level at best. Now you also might create your form and work paper library. Like Dan mentioned, there’s basically a gazillion different reporting jurisdictions with different forms that need to go out on a monthly basis, or even more frequently.

Karen Wilkins:

Now you want to also create your tax reporting calendar. Now this calendar really should include your tax identification numbers that were issued by the department of revenues or the localities. You want to do your filings correctly, your exhibits it’s going to be monthly, quarterly, annually or quarterly deposit, work in new works. You got your filing methodology. Is going to be paper? Is it going to be EDI? What’s your payment methodology? So that would be, am I going to mail a check-out? Am I going to file or am I going to send a wire?

Karen Wilkins:

Am I going to send an ACH debit or ACH credit or they going to come in and take the money from my account? Basically, you want your electronic filing and remittance login information as well. You want your pre-payment information as dictated by the state if it’s necessary. Of course, you also want your deadlines for your prepayments and your returns. So the return is going to be due on the 10th or the 30th. It’s important to keep that, especially as you grow your business near becoming more and more required to report to the various different jurisdictions.

Karen Wilkins:

And of course, if necessary you might want have a separate bank account to facilitate the ACH, the wire and the cheque payments as it relates to all your transaction tax remittances and even your regulatory remittances. So now that you see where we’re I’m talking about for the planned stage and say, you’re getting ready to start the return preparation and tax remittances. But also don’t forget to allocate time and resources to address the remittance that you most inevitably will receive. Even if you have perfect compliance, you can always count on receiving jurisdiction mail containing various due date reminders.

Karen Wilkins:

Frequency changes, rate changes, your address changes, even audit notices and we try to prevent those, right? Okay, onto the next slide, for me please Dan. All right. So now this is the detail, right? Now to prepare for compiling your downloads, the planning, there’s some additional components that you need to consider. And because of the various different tax types, the data must be very detailed. Typically for the data you’ll need that. And this might not necessarily a perfect world, but it’d be a good word for me, I love my data.

Karen Wilkins:

I need my tax type and I mean a tax type description. I need the authority level, whether it’s going to be federal or the state or city or county, you want have your geo code of sale or your zip plus four or city, county, district, state for accurate reporting your tax rate that you are charging, your tax amount. I would also want to say any non taxable and exempt revenue. I want to know what type of those exempt revenue they are.

Karen Wilkins:

I want to see the gross revenue, taxable revenue. Of course any additional details that would facilitate reconciliation to provide audit support down the path. So the more detail that you have, the better you’re armed to deal with some of those requests. Okay, now we’re ready to prepare the calculations. We filed the data and [inaudible 00:32:48] it. So, hey really, depending on how much bandwidth your tax pertinent, you may also want to structure your returns to prepare or be prepared by the due date.

Karen Wilkins:

So you might want to file your tents first, and then your tenant 15th and 20th, 25th, and then 30th. Of course, they all fall within that between basically most of them or between the 20th and 30th of each month. However there are some that are due as early as 10. And of course, if you are required to make three times in Illinois, the first one is due on the seventh of month. Now, of course, now you need to identify the specific data that you will need to prepare from that specific return filing.

Karen Wilkins:

If you’re preparing a Corpus Christi, Texas 911 return, you’ll need to identify that my own tax type and city and the total manual one tax for that specific jurisdiction. And that’s just one tiny little 911 return. Now, some returns are so complex that you may find yourself preparing separate work papers for each one. I have full state returns do not require an allegation by locality, but most do require revenue information by county and city and special districts. And Colorado is famous for that.

Karen Wilkins:

So majority of our States mandate online filing. So as far as how are you going to prepare? Some county and cities are actually mandate you to file online. Some states accommodate upload file so there is a possibility that you could prepare upload file. Of course, some of those kind of, they want to an XML format it can’t just be like a common delimited simple file. But a lot of the other ones they must be hanky, online anyway. Now there are some local jurisdictions within the home most states, including Alabama, Florida, Louisiana.

Karen Wilkins:

They have their own individual returns that need be completed and mailed. So keep that in mind. We kind of earlier the little, and also talked about all utility taxes in Missouri. However 911 it’s crazy about really, how many returns are out there? And as you broaden out and should expand your service territory, you’ll become more and more aware of this. So basically now it’s time to process your payments, right? State and localities they mandate ACH payment. They don’t want to see a cheque.

Karen Wilkins:

It could be an ACH debit, where I’m allowing the jurisdiction to come in and take money from our account. Or maybe ACH credit, which a lot of companies prefer to do. They want to send them money during the jurisdiction they don’t want the jurisdiction coming in and taking money from the checking account. We can’t blame them, right? Also there’s check limits that you’ve got to cut a cheque. You need to put that but in with the return itself, if you need to put it in the envelope, stamp it.

Karen Wilkins:

Of course, keep in mind that some jurisdictions, they don’t accept the postmark, right? Some of them don’t deserve and those… So those postmarks, those exceptions should be emailed overnight. Just that way you can say, “Okay, I found that it was delivered this date, this time.” Again additional support in case they come back and say, “Oh, you were late.” Of course now, as you think you’re really your compliance is kind of over, right? But it’s really not. Maybe for you it. It depends if your tax and accounting departments are combined or separated.

Karen Wilkins:

But hopefully you’ve tracked the payments that you’ve made. You’ve tracked the rounding that you’ve had to do because some jurisdictions, they report up to whole numbers, not just the dollars. They are not just the pennies. So they have a rounded and yet discounts received during preparation and final rates. Now it is important to balance your interim general ledger accounts. So you want to post your most tax payments to offset your cruel tax liability accounts, right?

Karen Wilkins:

And then you also want to push your income for those vendors discount that you get for timely filing. And then of course, you also have to post your expense for any bill, the interests, local license renewal fees applications. Last kind of all kind of the beginning of that compliance kind of to the end of the appliance. Now as far as the seamless process on the next slide basically wrapping up, sorry, Dan next slides for few things. So we’ve kind of covered the high level requirements for market entry, new tax determination collection and remits.

Karen Wilkins:

Now we started providing you a summary of the State Public Service Commissions. The Department of Revenue legislates that when the [inaudible 00:37:22] registrations are completed, you’ll need to begin preparing the necessary remits whether they’re tax nature or regulatory. Now completing the compliance process internally can be overwhelming and frustrating. The time needed to compile all your library and surge your data, maintain your calendar, process payments, and returns that really can be quite consuming. You might want to consider partnering with an outside firm or consultant to relieve you of that compliance burden.

Karen Wilkins:

Next slide, please. All right. And we’ve kind of tapped on exemptions earlier here and there. Early some additional considerations are that if your current reseller or contemplating resale of communication service, you may be exempt from federal taxes, right? However, there are other requirements to register as a reseller with the department of revenue, then possibly apply for reinstate resell certificates with the states.

Karen Wilkins:

Now your underlying carrier will require you to complete resale and capture forms on a regular basis. Again, just kind of re-summarizing what we’ve previously discussed. On the other hand, if you, as a reseller have inception customers, they will need to provide you with their inception certificate that you will then maintain or request for your renewal. Offers to pay non-state these exemption certificates will expire after a set point in time. I do appreciate your joining us today, and I’m going to pass this along for the closing by Dan.

Dan Driscoll:

Thanks for Karen. I’m sure everyone is trying to pick up some tidbits and all that good information that you kind of supplied in all those areas for sure. I think one of the things that if you get anything out of this is it don’t take tax compliance lightly. As Karen kind of talked to you about there is awful lot of components, it’s always changing. There are penalties and interests in all kinds of things associated with not being compliant. So it’s our recommendation to make sure that you’re doing whatever you need to do to be as compliant as possible when it comes to telecom tax. And hopefully we’ve given you some pointers here, where they kind of help you if you’re doing it internally.

Dan Driscoll:

And if you’re not certainly help you kind of get some ideas of what you need to do it from an outsourcing standpoint. So really if you’re looking for any additional information that we really haven’t supplied you in this webinar, you certainly can reach out to me either through my email or phone and we’ll get you whatever you need, if you’re missing something. Or if you heard something that you really want more information on, please reach out to us and then we’ll get you information as fast as we can. So I think we have a little time, Delaney, don’t we? For maybe a couple of questions before we end?

Delaney Dabkowski:

Yes, we do. And that was great, Dan and Karen. Thank you guys so much for your time. And before we do begin the Q and A portion of the presentation, I’d like to thank our audience for joining us today and review a few housekeeping items. The first reminder is that we’re always interested in topics that you’d like to learn more about. So please submit your topic ideas in the Q and A box. In addition, the full webinar recording will be emailed to you within two days. Lastly, if you’ve submitted any questions during the presentation that don’t get addressed in the live Q and A we will be following up with you individually via email. Now I’d like to ask a few questions from our audience. Our company has been collecting taxes and not remitting. What are our options?

Karen Wilkins:

Hi, its Karen. I’m definitely not an expert in this field, but you do have a few options. And it really depends on the state. And if you aren’t under audit by the jurisdiction where you need to re-merge. So if it was brought up by audit that you haven’t been collecting tax, then really you need some internal ones and some sport in addressing and assisting with those audits. However, if you haven’t been put under audit for that period, I mean, technically need to remit the tax file the appropriate returns.

Karen Wilkins:

And most likely you’ll have some penalty and interest that says with you have post returns as well. Now, another option is you could work with a jurisdiction, not submitting that a VDA or a voluntary disclosure agreement. And even that possibly only pay interest. The last thing, another option, it doesn’t come up very often, especially nowadays is you can also wait for a tax energy program offered by the jurisdiction. Again if it’s available or when it’s available. Of course, depending on the state, the program they wave and all the initiative associated with those fat taxes. Thanks for the question.

Delaney Dabkowski:

And our company provides data services. Do these services fall under federal state and local tax jurisdictions?

Dan Driscoll:

I can take that, Karen. Yeah, this is one of the questions I’ve kind of received with customers out there looking to move from even some of their agent models into a reseller models and handout. There are data or data center service and the quick answer is yes. There are taxes associated at the state level and the federal level associated with the various types of data services. So I think the only assumptions that you should have is that they are going to be taxed and you need to do the investigation and research to kind of see what types of taxes that you’re going to be obligated for your services as you go into the various states.

Delaney Dabkowski:

Well, that does look like those are all the questions that we have for today. Dan and Karen, thank you so much for your time and enjoy the rest of your day, everyone.

Dan Driscoll:

Thank you everybody for joining today.

Karen Wilkins:

Thanks everyone. Thanks Delaney.

Dan Driscoll:

Thank you very much.

Need help with telecom tax compliance?

Contact us today to get the conversation started.